|

20.06.2019 23:47:00

|

Metalla Completes Acquisition of Royalty on Agnico Eagle's El Realito Property and Adds Royalty on Minera Frisco's Orion Project From Alamos Gold

TSXV: MTA

OTC: MTAFF

VANCOUVER, June 20, 2019 /CNW/ - Metalla Royalty & Streaming Ltd. ("Metalla" or the "Company") (TSXV: MTA) (OTCQB: MTAFF) (FRANKFURT: X9CP) is pleased to announce that the Company has completed the second closing (the "Second Closing") to acquire 2 additional royalties from Alamos Gold Inc. (NYSE:AGI)(TSX:AGI) and its affiliates (collectively "Alamos"). The royalties acquired at the Second Closing are in addition to the royalties acquired at the first closing from Alamos on April 17, 2019. The Second Closing includes a development royalty on the El Realito property, which is a satellite deposit that is part of Agnico Eagle Mines Limited ("Agnico Eagle") (NYSE: AEM) La India mine located in Sonora Mexico ("the El Realito Royalty and an exploration royalty on the Biricu Property in Guerrero, Mexico (the "Biricu Royalty"). The Company has also agreed to purchase from Alamos a royalty (that was not part of the existing royalty package) on the Orion gold-silver project (the "Orion Project") owned by Minera Frisco S.A.B. C.V. located in Nayarit, Mexico (the "Orion Royalty") at a future third closing (the "Third Closing").

In connection with the Third Closing, the Company and Alamos have entered into an amended and restated purchase and sale agreement dated June 20, 2019 (the "Royalty Purchase Agreement") pursuant to which Metalla agreed to purchase the Orion Royalty from Alamos.

As consideration for the Biricu Royalty, Metalla issued to Alamos 10,299 common shares of the Company (the "Second Closing Shares"). The Second Closing Shares have a hold period expiring on October 21, 2019. As consideration for the Orion Royalty, Metalla expects to issue 257,491 common shares of the Company (the "Third Closing Shares"). The Third Closing Shares will be subject to a statutory four-month and one day hold period from the date of their issuance.

Metalla elected not to proceed with the acquisition of the royalty on the Choquelimpie property located in Chile as disclosed on April 17, 2019.

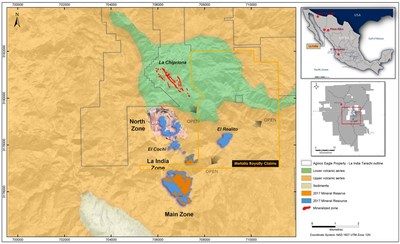

EL REALITO (2% NSR) ROYALTY

El Realito is a satellite deposit that is part of Agnico Eagle's operating La India mine in Sonora, Mexico. The mine was put into production in 2014 and Agnico Eagle disclosed that it produced over 100Koz of gold in 2018 at an AISC of US$685/Oz. In February 2019, Agnico Eagle declared its first reserve estimate at El Realito of 84Koz of gold and 418Koz of silver (3.3 million tonnes grading 0.80g/t gold and 3.96g/t silver) as of December 31, 2018(1). Agnico Eagle disclosed that as of December 31, 2018, it completed 15,879 metres of drilling in 2018 on El Realito and that it expected to drill an additional 10,000 metres for further mine-site exploration and 2,000 metres of infill drilling at El Realito and nearby targets in 2019. In Q1 2019, Agnico Eagle released drill holes testing parallel structures in the pit intersecting 1.4g/t gold and 5g/t silver over 22.4 meters in the northwest and extended the known resource mineralization to the south with hole INER19-239 intersecting 1.3g/t gold and 7g/t silver over 19.8 metres (2). Agnico Eagle disclosed that the system remained open and that the drill program is currently testing extensions of the system to expand the resource.

(1) | Refer to Agnico Eagle's Annual Information Form for the year ended December 31, 2018, and dated as of March 26, 2019. |

(2) | Refer to Agnico Eagle's First Quarter 2019 results dated April 25, 2019 |

ORION (2.75% NSR) ROYALTY

The Orion Royalty covers 30,782 hectares of the Orion Project located in Nayarit, Mexico in the prolific Sierra Madre Occidental mountain range. The exploration project is a low sulphidation epithermal underground deposit owned by Minera Frisco S.A.B de C.V. Minera Frisco purchased the Orion Project in October of 2012 as part of the acquisition of the Ocampo mine from AuRico Gold. Nayarit Gold Inc. filed a PEA(3) that was released on the project outlining a 5-year underground mine plan focused on the high-grade Animas/Del Norte veins. The project has an indicated resource of 1.1Mt at 8.81g/t Au-Eq for 314Koz Au-Eq.

(3) | NI 43-101 Preliminary Economic Assessment Nayarit Gold Inc. Orion Project, Animas/Del Norte Zone State of Nayarit, Mexico was filed on SEDAR by Nayarit Gold Inc. on February 24, 2010, and prepared by SRK Consulting |

UPDATED ROYALTY PORTFOLIO ACQUIRED FROM ALAMOS

Asset | Operator | Country | Stage | Terms | |

1 | El Realito | Agnico Eagle | Sonora, Mexico | Development | 2% NSR |

2 | La Fortuna | Minera Alamos | Durango, Mexico | Development | Option - 1% NSR |

3 | Wasamac | Monarch Gold | Rouyn-Noranda, Quebec | Development | 1.5% NSR |

4 | Beaufor Mine | Monarch Gold | Val d'Or, Quebec | Development | 1% NSR |

5 | San Luis | SSR Mining | Peru | Development | 1% NSR |

6 | Big Island | Copper Reef Mining | Flin Flon, Manitoba | Exploration | 2% NSR |

7 | Biricu | Guerrero Ventures | Guerrero, Mexico | Exploration | 2% NSR + $10/oz Ag |

8 | Boulevard | Independence Gold | Yukon, Ontario | Exploration | 1% NSR |

9 | Camflo Northwest | Monarch Gold | Val d'Or, Quebec | Exploration | 1% NSR |

10 | Edwards Mine | Waterton | Wawa, Ontario | Exploration | 1.25% NSR |

11 | Goodfish Kirana | Warrior Gold | Kirkland Lake, Ontario | Exploration | 1% NSR |

12 | Kirkland-Hudson | Kirkland Lake Gold | Kirkland Lake, Ontario | Exploration | 2% NSR |

13 | Pucarana | Buenaventura | Peru | Exploration | Option -1.8% NSR |

14 | Capricho | Pucara | Peru | Exploration | 1% NSR |

15 | Lourdes | Pucara | Peru | Exploration | 1% NSR |

16 | Santo Tomas | Pucara | Peru | Exploration | 1% NSR |

17 | Guadalupe/Pararin | Pucara | Peru | Exploration | 1% NSR |

18 | Orion | Minera Frisco | Nayarit, Mexico | Exploration | 2.75% NSR(4) |

(4) | Expected to be acquired at a future Third Closing date to be determined |

QUALIFIED PERSON

The technical information contained in this news release has been reviewed and approved by Charles Beaudry, geologist M.Sc., member of the Association of Professional Geoscientists of Ontario and the Ordre des Géologues du Québec and a consultant to Metalla. Mr. Beaudry is a Qualified Person as defined in "National Instrument 43-101 Standards of disclosure for mineral projects".

NO OFFER OR SOLICITATION

This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor will there be any sale of securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

ABOUT METALLA

Metalla is a precious metals royalty and streaming company. Metalla provides shareholders with leveraged precious metal exposure through a diversified and growing portfolio of royalties and streams. Our strong foundation of current and future cash-generating asset base, combined with an experienced team gives Metalla a path to become one of the leading gold and silver companies for the next commodities cycle.

For further information, please visit our website at www.metallaroyalty.com

ON BEHALF OF METALLA ROYALTY & STREAMING LTD.

(signed) "Brett Heath"

President and CEO

Neither the TSXV nor it's Regulation Services Provider (as that term is defined in the policies of the Exchange) accept responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and U.S. securities legislation. The forward-looking statements herein are made as of the date of this press release only, and the Company does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law.

Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements and information include, but are not limited to, the completion of the Third Closing, any exercise of options on royalties granted to Metalla by Alamos, anticipated cash flows upon completion of the transaction, future financial reporting by Metalla, the receipt of payments from Metalla's mining royalty and streaming portfolio, the requirement for regulatory approvals and third-party consents, the Company's financial guidance, outlook, proposed plans for acquiring additional stream and royalty interests and the potential of such streams and royalty interests to provide returns and the completion of mine expansion under construction phases at the mines or properties that the Company holds an interest in. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties, and contingencies. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Metalla to control or predict, that may cause Metalla's actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the requirement for regulatory approvals and third party consents, the impact of general business and economic conditions, the absence of control over the mining operations from which Metalla will purchase gold and receive royalties, including risks related to international operations, government relations and environmental regulation, the inherent risks involved in the exploration and development of mineral properties; the uncertainties involved in interpreting exploration data; the potential for delays in exploration or development activities; the geology, grade and continuity of mineral deposits; the possibility that future exploration, development or mining results will not be consistent with Metalla's expectations; accidents, equipment breakdowns, title matters, labor disputes or other unanticipated difficulties or interruptions in operations; fluctuating metal prices; unanticipated costs and expenses; uncertainties relating to the availability and costs of financing needed in the future; the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations; currency fluctuations; regulatory restrictions, including environmental regulatory restrictions; liability, competition, loss of key employees and other related risks and uncertainties. Metalla undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management's best judgment based on information currently available. No forward-looking statement can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information. Some of the disclosure in this press release is based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at the date hereof, and none of this information has been independently verified by Metalla.

Readers are cautioned that forward-looking statements are not guarantees of future performance. All of the forward-looking statements made in this press release are qualified by these cautionary statements.

SOURCE Metalla Royalty and Streaming Ltd.

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!