|

29.09.2022 14:00:00

|

Expert panel: Expect a buyers' market before the end of 2023

Zillow polls panel of housing experts for 2023 forecasts and beyond

- Metros in the South and Midwest are the least likely to see price declines over the next year.

- Vacation market areas are most likely to see price declines.

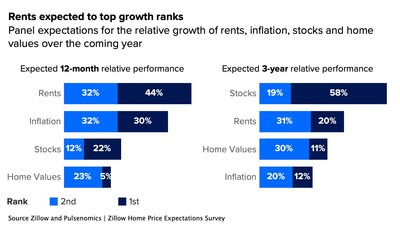

- Rent growth and inflation should outpace appreciation in home prices and the stock market over the next year.

SEATTLE, Sept. 29, 2022 /PRNewswire/ -- Sky-high mortgage costs are driving down competition among home shoppers, and a market firmly in favor of buyers is expected before the end of next year, according to a majority of economists and housing experts surveyed by Zillow®. The panel also expects rent growth to outpace inflation during the next 12 months, as priced-out potential home buyers exert additional pressure on the rental market.

Home value growth, which hit record highs over the course of the pandemic, is now slowing as affordability challenges magnified by quickly rising mortgage rates are pushing many buyers to the sidelines. Values are ticking down slightly across the U.S. and declining more steeply in some of the most expensive metros, as well as those metros that grew the fastest over the past two years.

Although home price growth has slowed, the market is far from pre-pandemic norms. Zillow's latest market report showed listings' typical time on market, while rising, is still 11 days shorter than in 2019. Inventory is ticking up as well, but is still down almost 42% compared to 2019. The majority of the panel (56%) expects a significant shift in buyers' favor by sometime next year. Another 24% predicted that shift would come in 2024, 13% pointed to 2025, and just 8% expect it after 2025.

"After the frantic rush for real estate over the past two years, buyers are finally seeing a calmer market. Those still able to afford homeownership are quickly regaining lost leverage, but this shift to a more balanced market is still in its early stages," said Nicole Bachaud, senior economist at Zillow. "Home shoppers priced out of the market are in a tight spot, though, as high and rising rents could cut further into their ability to save up for a down payment."

Inexpensive Midwest markets — such as Columbus, Indianapolis and Minneapolis — are the least likely to see home prices decline over the next 12 months, according to survey respondents. Fast-growing markets in the South, like Atlanta, Nashville and Charlotte, are also expected to retain their heat.

Markets projected to cool the fastest are those that saw some of the largest growth over the course of the pandemic, including Boise, Austin and Raleigh.

Suburban and exurban areas are predicted by the panel to retain their heat over the next 12 months, while vacation areas were considered the most likely to see price declines.

Rent growth should remain strong in the short term as high home prices keep many would-be first-time buyers in the rental market. Over the next 12 months, rents are expected to grow more than inflation, the stock market and home values.

The panelists predict an average of 5.4% rent growth throughout 2023 — lower than the 8.6% annual growth they expect to see by the end of this year, but still higher than what Zillow data shows to be just under 4% annual growth in the years prior to the pandemic.

This demand for rentals has already spawned new supply in the pipeline. Builders responded to declining home purchases by ramping up construction on multifamily units, bringing starts to their highest level in years. The panel projects the stock market will rebound over the next three years, outpacing growth in home prices and rents as overall inflation cools.

Although the panel-wide 2022 expected home price appreciation rate ticked up to 9.8% from 9.3% in this most recent survey, all 107 survey respondents project home price deceleration in 2023. The share of panelists who believe their long-term outlook might be too optimistic jumped up to 67% from 56% last quarter.

"U.S. home price appreciation is clearly easing up in response to the historic surge in mortgage rates," said Terry Loebs, founder of Pulsenomics. "Our expert panel's mean projections indicate that residential rent price growth is expected to outpace headline CPI inflation over the coming three years and exceed home price growth through at least 2025. Despite softening house prices, this implies that affordability hurdles for prospective first-time homeowners will remain high and persist for years to come."

About Zillow Group

Zillow Group, Inc. (NASDAQ: Z and ZG) is reimagining real estate to make it easier to unlock life's next chapter. As the most visited real estate website in the United States, Zillow® and its affiliates offer customers an on-demand experience for selling, buying, renting or financing with transparency and ease.

Zillow Group's affiliates and subsidiaries include Zillow®, Zillow Premier Agent®, Zillow Home Loans™, Zillow Closing Services™, Trulia®, Out East®, ShowingTime®, Bridge Interactive®, dotloop®, StreetEasy® and HotPads®. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org).

About Pulsenomics

Pulsenomics LLC (www.pulsenomics.com) is an independent research firm that specializes in data analytics, opinion research, new product and index development for institutional clients in the financial and real estate arenas. Pulsenomics also designs and manages expert surveys and consumer polls to identify trends and expectations that are relevant to effective business management and monitoring economic health. Pulsenomics LLC is the author of The Home Price Expectations Survey™, The U.S. Housing Confidence Survey, The Housing Confidence Index, and The Transaction Sentiment Index. Pulsenomics®, The Housing Confidence Index™, The Transaction Sentiment Index™, and The Housing Confidence Survey™ are trademarks of Pulsenomics LLC.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/expert-panel-expect-a-buyers-market-before-the-end-of-2023-301636390.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/expert-panel-expect-a-buyers-market-before-the-end-of-2023-301636390.html

SOURCE Zillow

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Zillow Group Inc (C)mehr Nachrichten

|

05.11.24 |

Ausblick: Zillow Group verkündet Quartalsergebnis zum jüngsten Jahresviertel (finanzen.net) | |

|

22.10.24 |

Erste Schätzungen: Zillow Group öffnet die Bücher zum abgelaufenen Quartal (finanzen.net) | |

|

06.08.24 |

Ausblick: Zillow Group gibt Ergebnis zum abgelaufenen Quartal bekannt (finanzen.net) | |

|

23.07.24 |

Erste Schätzungen: Zillow Group stellt Quartalsergebnis zum abgelaufenen Jahresviertel vor (finanzen.net) |

Analysen zu Zillow Group Inc (C)mehr Analysen

Aktien in diesem Artikel

| Zillow Group Inc (A) | 73,38 | -0,03% |

|

| Zillow Group Inc (C) | 76,62 | 0,26% |

|