|

30.11.2022 15:00:00

|

TrueCar Releases Analysis of November Industry Sales

OEMs' first response to increasing inventories is to pull the fleet lever

SANTA MONICA, Calif., Nov. 30, 2022 /PRNewswire/ -- TrueCar, Inc. (NASDAQ: TRUE), the easiest, most efficient and transparent online destination for buying and selling new and used vehicles, expects total new vehicle industry sales to reach 1,136,329 units in November 2022, up 7% from a year ago and about on par with October 2022, when adjusted for the same number of selling days. This month's seasonally adjusted annualized rate (SAAR) for total light vehicle industry sales is an estimated 14 million, up 9% from November 2021. Excluding fleet sales, TrueCar expects U.S. retail deliveries of new cars and light trucks to be 954,799 units, about even from a year ago and down about 3% from October 2022.

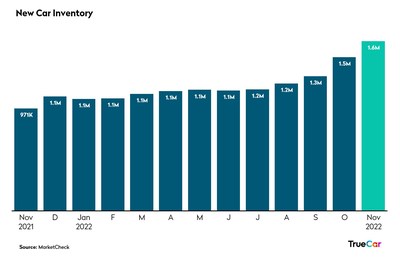

"Inventories are on pace for a fourth consecutive month of double-digit increases. Consumers, however, continue to face affordability challenges and high monthly payments, keeping many on the sidelines," said Zack Krelle, Industry Analyst at TrueCar. "To maintain sales momentum, manufacturers appear to be shifting some of the new supply to non-retail sales."

November fleet sales are up 68% year-over-year, and up 21% over October.

"A TrueCar survey showed that 77% of shoppers are brand agnostic, open to finding whichever make meets their needs. Because incentives and price reductions have not yet materialized, there's a larger potential for brand conquesting," said Justin Colon, Vice President of OEM Solutions at TrueCar. "There is potential for a growth-minded OEM to lean into this opportunity."

Additional November Industry Insights (from TrueCar):

- Total sales for November 2022 are expected to be up 7% from a year ago and about even with October 2022 when adjusted for the same number of selling days.

- Fleet sales for November 2022 are expected to be up 68% from a year ago and up 21% from October 2022 when adjusted for the same number of selling days.

- Average transaction price for new vehicles is projected to be up 3% from a year ago and down 1% from October 2022.

- Total SAAR is expected to be up 9% from a year ago at 14 million units.

- Used vehicle sales for November 2022 are expected to reach almost 3 million, down 13% from a year ago and even with October 2022.

- The average interest rate on new vehicles is 6.6% compared to October 2022 at 6.3% and the average interest rate on used vehicles is 9.8%.

- The average loan term on a new vehicle for November 2022 is about 70 months and the average loan term on a used vehicle is about 71 months.

Total Unit Sales | |||||||

Manufacturer | Nov 2022 Forecast | Nov 2021 Actual | Oct 2022 Actual | YoY % Change | YoY % Change | MoM % Change | MoM % Change |

BMW | 30,798 | 30,441 | 33,398 | 1.2 % | -2.9 % | -7.8 % | -4.1 % |

Daimler | 26,483 | 25,101 | 29,425 | 5.5 % | 1.3 % | -10.0 % | -6.4 % |

Ford | 149,857 | 157,417 | 156,917 | -4.8 % | -8.6 % | -4.5 % | -0.7 % |

GM | 199,521 | 139,618 | 201,296 | 42.9 % | 37.2 % | -0.9 % | 3.1 % |

Honda | 82,410 | 85,055 | 81,545 | -3.1 % | -7.0 % | 1.1 % | 5.1 % |

Hyundai | 62,626 | 49,347 | 64,957 | 26.9 % | 21.8 % | -3.6 % | 0.3 % |

Kia | 56,595 | 45,318 | 58,276 | 24.9 % | 19.9 % | -2.9 % | 1.0 % |

Nissan | 64,595 | 57,625 | 66,678 | 12.1 % | 7.6 % | -3.1 % | 0.8 % |

Stellantis | 110,357 | 125,415 | 111,941 | -12.0 % | -15.5 % | -1.4 % | 2.5 % |

Subaru | 46,700 | 33,045 | 48,568 | 41.3 % | 35.7 % | -3.8 % | 0.0 % |

Tesla | 41,537 | 33,980 | 43,198 | 22.2 % | 17.3 % | -3.8 % | 0.0 % |

Toyota | 173,583 | 154,139 | 187,367 | 12.6 % | 8.1 % | -7.4 % | -3.7 % |

Volkswagen Group | 44,998 | 41,642 | 48,506 | 8.1 % | 3.7 % | -7.2 % | -3.5 % |

Industry | 1,136,329 | 1,021,610 | 1,181,176 | 11.2 % | 6.8 % | -3.8 % | 0.1 % |

Retail Unit Sales | |||||||

Manufacturer | Nov 2022 Forecast | Nov 2021 Actual | Oct 2022 Actual | YoY % Change | YoY % Change | MoM % Change | MoM % Change |

BMW | 28,948 | 28,811 | 30,719 | 0.5 % | -3.5 % | -5.8 % | -2.0 % |

Daimler | 24,336 | 22,899 | 27,379 | 6.3 % | 2.0 % | -11.1 % | -7.6 % |

Ford | 106,765 | 122,181 | 117,377 | -12.6 % | -16.1 % | -9.0 % | -5.4 % |

GM | 148,007 | 125,465 | 166,418 | 18.0 % | 13.2 % | -11.1 % | -7.5 % |

Honda | 80,327 | 84,618 | 79,266 | -5.1 % | -8.9 % | 1.3 % | 5.4 % |

Hyundai | 61,057 | 48,706 | 64,207 | 25.4 % | 20.3 % | -4.9 % | -1.1 % |

Kia | 54,632 | 42,539 | 56,318 | 28.4 % | 23.3 % | -3.0 % | 0.9 % |

Nissan | 56,932 | 51,233 | 54,410 | 11.1 % | 6.7 % | 4.6 % | 8.8 % |

Stellantis | 76,486 | 100,611 | 89,438 | -24.0 % | -27.0 % | -14.5 % | -11.1 % |

Subaru | 45,699 | 32,378 | 47,294 | 41.1 % | 35.5 % | -3.4 % | 0.5 % |

Tesla | 35,023 | 33,656 | 36,193 | 4.1 % | -0.1 % | -3.2 % | 0.6 % |

Toyota | 155,752 | 144,204 | 167,783 | 8.0 % | 3.7 % | -7.2 % | -3.5 % |

Volkswagen Group | 40,363 | 40,941 | 44,314 | -1.4 % | -5.4 % | -8.9 % | -5.3 % |

Industry | 954,799 | 919,212 | 1,025,020 | 3.9 % | -0.3 % | -6.9 % | -3.1 % |

Fleet Unit Sales | |||||||

Manufacturer | Nov 2022 Forecast | Nov 2021 Actual | Oct 2022 Actual | YoY % Change | YoY % Change | MoM % Change | MoM % Change |

BMW | 1,850 | 1,630 | 2,679 | 13.5 % | 8.9 % | -31.0 % | -28.2 % |

Daimler | 2,147 | 2,202 | 2,046 | -2.5 % | -6.4 % | 4.9 % | 9.1 % |

Ford | 43,092 | 35,236 | 39,540 | 22.3 % | 17.4 % | 9.0 % | 13.3 % |

GM | 51,514 | 14,153 | 34,878 | 264.0 % | 249.4 % | 47.7 % | 53.6 % |

Honda | 2,083 | 437 | 2,279 | 377.1 % | 358.0 % | -8.6 % | -4.9 % |

Hyundai | 1,569 | 641 | 750 | 144.7 % | 134.9 % | 109.2 % | 117.6 % |

Kia | 1,963 | 2,779 | 1,958 | -29.4 % | -32.2 % | 0.2 % | 4.3 % |

Nissan | 7,663 | 6,392 | 12,268 | 19.9 % | 15.1 % | -37.5 % | -35.0 % |

Stellantis | 33,871 | 24,804 | 22,503 | 36.6 % | 31.1 % | 50.5 % | 56.5 % |

Subaru | 1,001 | 667 | 1,274 | 50.1 % | 44.1 % | -21.4 % | -18.3 % |

Tesla | 6,514 | 324 | 7,005 | 1910.2 % | 1829.8 % | -7.0 % | -3.3 % |

Toyota | 17,831 | 9,935 | 19,584 | 79.5 % | 72.3 % | -9.0 % | -5.3 % |

Volkswagen Group | 4,635 | 701 | 4,192 | 560.7 % | 534.3 % | 10.6 % | 15.0 % |

Industry | 178,597 | 102,200 | 153,223 | 74.8 % | 67.8 % | 16.6 % | 21.2 % |

Fleet Penetration | |||||

Manufacturer | Nov 2022 Forecast | Nov 2021 Actual | Oct 2022 Actual | YoY % Change | MoM % Change |

BMW | 6.0 % | 5.4 % | 8.0 % | 12.2 % | -25.1 % |

Daimler | 8.1 % | 8.8 % | 7.0 % | -7.6 % | 16.6 % |

Ford | 28.8 % | 22.4 % | 25.2 % | 28.5 % | 14.1 % |

GM | 25.8 % | 10.1 % | 17.3 % | 154.7 % | 49.0 % |

Honda | 2.5 % | 0.5 % | 2.8 % | 392.4 % | -9.6 % |

Hyundai | 2.5 % | 1.3 % | 1.2 % | 92.8 % | 117.0 % |

Kia | 3.5 % | 6.1 % | 3.4 % | -43.4 % | 3.2 % |

Nissan | 11.9 % | 11.1 % | 18.4 % | 7.0 % | -35.5 % |

Stellantis | 30.7 % | 19.8 % | 20.1 % | 55.2 % | 52.7 % |

Subaru | 2.1 % | 2.0 % | 2.6 % | 6.2 % | -18.3 % |

Tesla | 15.7 % | 1.0 % | 16.2 % | 1544.5 % | -3.3 % |

Toyota | 10.3 % | 6.4 % | 10.5 % | 59.4 % | -1.7 % |

Volkswagen Group | 10.3 % | 1.7 % | 8.6 % | 511.4 % | 19.2 % |

Industry | 15.7 % | 10.0 % | 13.0 % | 57.1 % | 21.2 % |

Total Market Share | |||

Manufacturer | Nov 2022 Forecast | Nov 2021 Actual | Oct 2022 Actual |

BMW | 2.7 % | 3.0 % | 2.8 % |

Daimler | 2.3 % | 2.5 % | 2.5 % |

Ford | 13.2 % | 15.4 % | 13.3 % |

GM | 17.6 % | 13.7 % | 17.0 % |

Honda | 7.3 % | 8.3 % | 6.9 % |

Hyundai | 5.5 % | 4.8 % | 5.5 % |

Kia | 5.0 % | 4.4 % | 4.9 % |

Nissan | 5.7 % | 5.6 % | 5.6 % |

Stellantis | 9.7 % | 12.3 % | 9.5 % |

Subaru | 4.1 % | 3.2 % | 4.1 % |

Tesla | 3.7 % | 3.3 % | 3.7 % |

Toyota | 15.3 % | 15.1 % | 15.9 % |

Volkswagen Group | 4.0 % | 4.1 % | 4.1 % |

95.9 % | 95.7 % | 95.8 % | |

Retail Market Share | |||

Manufacturer | Nov 2022 Forecast | Nov 2021 Actual | Oct 2022 Actual |

BMW | 3.0 % | 3.1 % | 3.0 % |

Daimler | 2.5 % | 2.5 % | 2.7 % |

Ford | 11.2 % | 13.3 % | 11.5 % |

GM | 15.5 % | 13.6 % | 16.2 % |

Honda | 8.4 % | 9.2 % | 7.7 % |

Hyundai | 6.4 % | 5.3 % | 6.3 % |

Kia | 5.7 % | 4.6 % | 5.5 % |

Nissan | 6.0 % | 5.6 % | 5.3 % |

Stellantis | 8.0 % | 10.9 % | 8.7 % |

Subaru | 4.8 % | 3.5 % | 4.6 % |

Tesla | 3.7 % | 3.7 % | 3.5 % |

Toyota | 16.3 % | 15.7 % | 16.4 % |

Volkswagen Group | 4.2 % | 4.5 % | 4.3 % |

95.8 % | 95.5 % | 95.7 % | |

ATP | |||||

Manufacturer | Nov 2022 Forecast | Nov 2021 Actual | Oct 2022 Actual | YOY | MOM |

BMW | $68,658 | $61,769 | $70,318 | 11.2 % | -2.4 % |

Daimler | $73,959 | $67,617 | $71,784 | 9.4 % | 3.0 % |

Ford | $54,233 | $48,709 | $52,756 | 11.3 % | 2.8 % |

GM | $53,079 | $54,388 | $52,043 | -2.4 % | 2.0 % |

Honda | $37,101 | $35,176 | $37,913 | 5.5 % | -2.1 % |

Hyundai | $36,706 | $35,814 | $37,143 | 2.5 % | -1.2 % |

Kia | $34,252 | $33,620 | $34,383 | 1.9 % | -0.4 % |

Nissan | $36,964 | $34,290 | $37,094 | 7.8 % | -0.4 % |

Stellantis | $55,408 | $52,665 | $54,693 | 5.2 % | 1.3 % |

Subaru | $35,392 | $34,767 | $34,855 | 1.8 % | 1.5 % |

Toyota | $41,297 | $40,227 | $39,908 | 2.7 % | 3.5 % |

Volkswagen Group | $47,418 | $44,754 | $45,682 | 6.0 % | 3.8 % |

Industry | $45,290 | $44,074 | $44,769 | 2.8 % | 1.2 % |

$1,216 | $521 | ||||

Incentives | |||||

Manufacturer | Nov 2022 Forecast | Nov 2021 Actual | Oct 2022 Actual | YOY | MOM |

BMW | $1,305 | $2,786 | $1,366 | -53.2 % | -4.4 % |

Daimler | $1,209 | $2,427 | $1,286 | -50.2 % | -6.0 % |

Ford | $965 | $2,462 | $1,020 | -60.8 % | -5.4 % |

GM | $1,334 | $1,829 | $1,377 | -27.1 % | -3.2 % |

Honda | $1,028 | $1,599 | $1,050 | -35.7 % | -2.1 % |

Hyundai | $1,056 | $1,209 | $855 | -12.6 % | 23.5 % |

Kia | $552 | $1,652 | $423 | -66.6 % | 30.6 % |

Nissan | $1,349 | $1,995 | $1,437 | -32.4 % | -6.2 % |

Stellantis | $1,604 | $2,465 | $1,333 | -34.9 % | 20.4 % |

Subaru | $638 | $1,058 | $671 | -39.7 % | -4.9 % |

Toyota | $720 | $1,257 | $754 | -42.7 % | -4.5 % |

Volkswagen Group | $1,650 | $2,089 | $1,506 | -21.0 % | 9.6 % |

Industry | $1,072 | $1,903 | $1,060 | -43.7 % | 1.1 % |

-$831 | $12 | ||||

Incentives as % of ATP | |||||

Manufacturer | Nov 2022 Forecast | Nov 2021 Actual | Oct 2022 Actual | YOY | MOM |

BMW | 1.9 % | 4.5 % | 1.9 % | -57.9 % | -2.1 % |

Daimler | 1.6 % | 3.6 % | 1.8 % | -54.5 % | -8.8 % |

Ford | 1.8 % | 5.1 % | 1.9 % | -64.8 % | -8.0 % |

GM | 2.5 % | 3.4 % | 2.6 % | -25.3 % | -5.1 % |

Honda | 2.8 % | 4.5 % | 2.8 % | -39.1 % | 0.1 % |

Hyundai | 2.9 % | 3.4 % | 2.3 % | -14.8 % | 25.0 % |

Kia | 1.6 % | 4.9 % | 1.2 % | -67.2 % | 31.1 % |

Nissan | 3.6 % | 5.8 % | 3.9 % | -37.3 % | -5.8 % |

Stellantis | 2.9 % | 4.7 % | 2.4 % | -38.1 % | 18.8 % |

Subaru | 1.8 % | 3.0 % | 1.9 % | -40.7 % | -6.3 % |

Toyota | 1.7 % | 3.1 % | 1.9 % | -44.2 % | -7.7 % |

Volkswagen Group | 3.5 % | 4.7 % | 3.3 % | -25.4 % | 5.6 % |

Industry | 2.4 % | 4.3 % | 2.4 % | -45.2 % | 0.0 % |

Revenue | |||||

Manufacturer | Nov 2022 Forecast | Nov 2021 Actual | Oct 2022 Actual | YOY | MOM |

Industry | $51,464,397,411 | $45,026,320,944 | $52,880,515,204 | 14.3 % | -2.7 % |

(Note: This industry insight is based solely on TrueCar, Inc.'s analysis of domestic industry sales trends and conditions and is not a projection of TrueCar, Inc.'s operations.)

About TrueCar

TrueCar is a leading automotive digital marketplace that lets auto buyers and sellers connect to our nationwide network of Certified Dealers. With access to an expansive inventory provided by our Certified Dealers, we are building the industry's most personalized and efficient auto shopping experience as we seek to bring more of the process online. Consumers who visit our marketplace will find a suite of vehicle discovery tools, price ratings and market context on new, used and Certified Pre-Owned vehicles. When they are ready, shoppers in TrueCar's marketplace can connect with a Certified Dealer in our network, who shares our belief that truth, transparency and fairness are the foundation of a great auto shopping experience. As part of our marketplace, TrueCar powers auto-buying programs for over 250 leading brands, including AARP, Sam's Club, Navy Federal Credit Union and American Express.

For more information, please visit www.truecar.com, and follow us on LinkedIn, Facebook or Twitter.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/truecar-releases-analysis-of-november-industry-sales-301689981.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/truecar-releases-analysis-of-november-industry-sales-301689981.html

SOURCE TrueCar.com

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu TrueCar Incmehr Nachrichten

|

05.11.24 |

Ausblick: TrueCar mit Zahlen zum abgelaufenen Quartal (finanzen.net) |

Analysen zu TrueCar Incmehr Analysen

Aktien in diesem Artikel

| TrueCar Inc | 3,36 | -1,18% |

|