|

08.09.2020 18:30:00

|

TD Ameritrade Investor Movement Index: IMX Continued to Rise in August

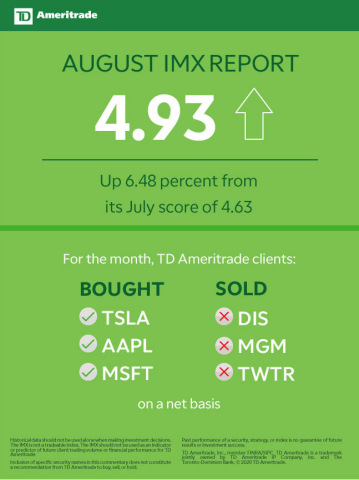

The Investor Movement Index® (IMXSM) increased to 4.93 in August, up 6.48 percent from its July score of 4.63. The IMX is TD Ameritrade’s proprietary, behavior-based index, aggregating Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200908005077/en/

TD Ameritrade August 2020 Investor Movement Index (Graphic: TD Ameritrade)

The reading for the four-week period ending August 28, 2020, ranks "Moderate Low” compared to historic averages.

"In August, the market had an incredible run as the technology stocks led the way,” said JJ Kinahan, chief market strategist at TD Ameritrade. "TD Ameritrade clients used this opportunity to increase their exposure to the market for the sixth month in a row, and in many cases were buyers of these market-leading technology stocks.”

Equity markets continued their upward trend during the August period, with the S&P 500 and Nasdaq Composite both ending the period at record highs and crossing historic marks. Technology stocks led the charge as the Nasdaq Composite increased by 8.84 percent. The move higher was bolstered by hopes that a COVID-19 vaccine is on the horizon, given multiple announcements from the Food and Drug Administration (FDA) and others. The Federal Reserve announced it will adopt flexible average inflation targeting into its monetary policy framework, which will allow inflation to rise "moderately” above its two percent target while keeping its benchmark interest rate near zero. Also making headlines during the period were Apple Inc. (AAPL) and Tesla Inc. (TSLA), with Apple announcing its fifth stock split and Tesla announcing its first.

TD Ameritrade clients were net buyers of equities, and net buyers overall. Buying was the heaviest among Information Technology, Consumer Discretionary, and Health Care sectors, with additional buying in Fixed Income. Some of the popular names that clients bought during the period included:

- Tesla, Inc. (TSLA)

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- Teledoc Health Inc. (TDOC)

- Moderna Inc. (MRNA)

Some of the names that they net sold during the period included:

- The Walt Disney Company (DIS)

- MGM Resorts International (MGM)

- Twitter (TWTR)

- Ford Motor Co. (F)

- Halliburton Co. (HAL)

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of more than 13 million funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX.

For more information on the Investor Movement Index, including historical IMX data going back to January 2010; to view the full report from August 2020; or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or thinkorswim Mobile platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold. All investments involve risk including the possible loss of principal. Please consider all risks and objectives before investing.

Past performance of a security, strategy, or index is no guarantee of future results or investment success.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade.

About TD Ameritrade Holding Corporation

TD Ameritrade provides investing services and education to approximately 13 million client accounts totaling approximately $1.5 trillion in assets, and custodial services to more than 7,000 registered investment advisors. We are a leader in U.S. retail trading, executing more than 3 million daily average revenue trades per day for our clients, one-third of which come from mobile devices. We have a proud history of innovation, dating back to our start in 1975, and today our team of nearly 10,000-strong is committed to carrying it forward. Together, we are leveraging the latest in cutting edge technologies and one-on-one client care to transform lives, and investing, for the better. Learn more by visiting TD Ameritrade’s newsroom at www.amtd.com, or read our stories at Fresh Accounts.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org)

Source: TD Ameritrade Holding Corporation

View source version on businesswire.com: https://www.businesswire.com/news/home/20200908005077/en/

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu TD Ameritrade Holding CorpShsmehr Nachrichten

| Keine Nachrichten verfügbar. |