|

27.07.2017 09:00:00

|

SoLocal Group: H1 2017: Growth of Internet Revenues, Good Performance of Digital Marketing, but Margin Deterioration

Regulatory News:

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170726006551/en/

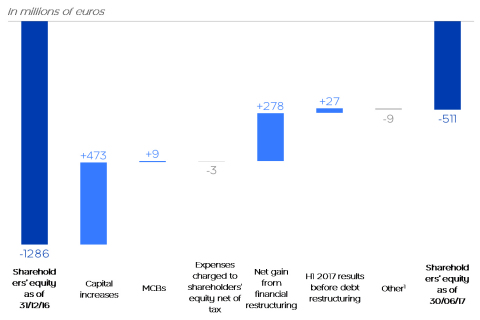

Shareholders’ equity 1Changes in shareholders’ equity without any impact on net income

H1 2017 results :

- Internet revenues : €323 million, +1%1

- EBITDA2 : €91 million, -18%1, EBITDA3 to revenue margin of 24%

Outlook for 2017 revised downward :

- Internet revenue growth : +1% to +3%1

- EBITDA2 : = €200 million

As announced, the Internet growth of this last quarter has been impacted negatively by uncertainty related to the financial restructuring of end 2016. Furthermore, the sales order dynamic has been slowed down over recent weeks by a slower adoption of our higher value Search products, which will ultimately make our audiences more profitable. The engaged action plan to foster these new solution adoption by our clients give early positive signs. At the same time, our Digital Marketing offerings continue to be a source of strong growth.

The Board of Directors welcomes the quality of the candidates for the position of SoLocal’s CEO and will be able to announce the name of the new CEO at the end of the summer.

1 In H1 2017 vs H1 2016 (scope : continued activities)

2

Total recurring EBITDA (Internet + Print & Voice)

3 EBITDA

to revenue margin : EBITDA / total revenues, before non recurring items

I. Revenues and EBITDA

The Board of Directors approved the Group’s consolidated accounts as of 30 June 2017.

| In millions of euros | H1 2016 | H1 2017 | Change | |||

| Internet revenues | 322 | 323 | +1% | |||

| Local Search | 243 | 235 | -3% | |||

| Number of visits (in million) | 1,206 | 1,256 | +4% | |||

| ARPA1 (in €) | 485 | 492 | +1% | |||

| Number of clients (in thousand) | 501 | 477 | -5% | |||

| Digital Marketing | 78 | 88 | +13% | |||

| Penetration rate (in number of clients) | 23% | 24% | +1pt | |||

| Print & Voice revenues | 83 | 62 | -25% | |||

| Revenues | 405 | 386 | -5% |

1 Average Revenue Per Advertiser

The Group recorded revenues of

€386 million in H1 2017, down -5% vs H1 2016.

Internet revenues of €323 million in H1 2017 were up +1% vs H1 2016, the strong Digital Marketing growth being partly offset by short-term decrease of Local Search.

- Audience growth: a steady audience growth of +4% in H1 2017 vs H1 2016, of which a mobile audience growth of +17%1.

- Local search revenues: -3% in H1 2017 vs H1 2016 :

- Local Search ARPA3: +1%1, a growth slowdown related to the end of offering upgrade effect and to the impact of financial restructuring on commercial activity in Q4 2016

- Client base: -5%1, slowdown of client base decrease reflecting the early improvement of retention

- Digital Marketing revenues: +13%1, acceleration of Digital Marketing with great successes of Booster contact and Sites privilèges (high-end websites) offerings. The Digital Marketing revenues represent 27% of Internet revenues this half-year.

Print & Voice revenues of €62 million in H1 2017 decreased by -25% vs H1 2016. This business accounts for 16% of total revenues this half-year.

| In millions of euros | H1 2016 | H1 2017 | Change | |||

| Internet recurring EBITDA | 90 | 81 | -9% | |||

| EBITDA / revenue margin | 28% | 25% | -3 pts | |||

| Print & Voice recurring EBITDA | 22 | 10 | -56% | |||

| EBITDA / revenue margin | 27% | 15% | -11 pts | |||

| Recurring EBITDA | 112 | 91 | -18% | |||

| EBITDA / revenue margin | 28% | 24% | -4 pts |

Note: Table concerning the continued activities

Recurring EBITDA was €91 million in H1 2017, down -18% vs H1 2016 (the EBITDA to revenue margin reached 24% in H1 2017, down by 4 points vs H1 2016), mainly due to the reduction of Print & Voice contribution (EBITDA to revenue margin declined from 27% to 15% for this business line) and the Local Search revenue decrease, leading to a contraction of Internet EBITDA margin from 28% to 25%.

1 In H1 2017 vs H1 2016 (scope : continued activities)

2

EBITDA to revenue margin : EBITDA / total revenues, before non

recurring items

II. Net income and financial structure

| In millions of euros | H1 2016 1 | H1 2017 | Change | |||

| Recurring EBITDA | 112 | 91 | -18% | |||

| Depreciation and amortisation 1 | (27) | (30) | +11% | |||

| Net financial expense before debt restructuring | (37) | (11) | +71% | |||

| Corporate income tax 1 | (21) | (21) | -2% | |||

| Recurring income | 27 | 29 | +11% | |||

| Contribution to net income from non recurring items | (1) | (2) | +37% | |||

| Net gain from debt restructuring | - | 278 | na | |||

| Net income | 25 | 306 | na |

1 restated for the retrospective application of IAS 20 concerning the CIR

Depreciation and amortisation amounted to -€30 million in H1 2017, up +11% vs H1 2016, mainly related to the launch of new intelligent search engine.

The financial result before debt restructuring was -€11 million in H1 2017, an improvement of +71% compared to H1 2016, mainly resulting from debt reduction.

Corporate income tax amounted to -€21 million in H1 2017, a decrease of 2% vs H1 2016.

Recurring income from continued activities amounted to €29 million in H1 2017, up +11% compared to H1 2016.

In H1 2017, the group recorded a net gain of €278 million resulting from the restructuring of its debt. This gain resulted mainly from a positive non-monetary difference of €298 million (without any tax impact) between the carrying amount of the debt converted into equity instruments and the fair value of these instruments in accordance with IFRIC 19.

The Group’s net income totalled €306 million in H1 2017, compared to net income of €25 million in H1 2016.

Net debt3 totalled €355 million as of 30 June 2017. The financial leverage covenant was 1.71x at this date.

The Group’s net cash flow from continued activities was -€46 million in H1 2017, -€14m excluding 2016 interests related to the debt before financial restructuring (€32 million), down €48m reflecting an increase of corporate income tax paid, the decrease of EBITDA and a temporarily higher deterioration of working capital needs related to the product mix evolution.

As of 30 June 2017, the Group had a net cash position of €48 million4.

1

Net debt is the gross financial debt plus or minus the fair net asset

value of asset and/or liability derivative instruments used for cash

flow hedging purposes, minus cash and cash equivalents.

III. Outlook

The sales order trend slowed down in Q2 2017. Indeed, the upgrade of our customers' Search offerings towards higher value products, which will ultimately make our audiences more profitable, takes longer than originally planned. Expenses and investments are managed accordingly.

Therefore, the Group revised downward its outlook for 2017 :

|

2016 |

2017 |

|||||||

|

former |

new |

|||||||

|

outlook |

outlook |

|||||||

| Internet revenue growth : | +1% | +3% to +5% | +1% to +3% | |||||

| EBITDA1 : | €229m | €210 to 225m | = €200m |

1 Total recurring EBITDA (Internet + Print & Voice)

About SoLocal Group

SoLocal Group, European leader in local

online communication, reveals local know-how, and boosts local revenues

of businesses. The Internet activities of the Group are structured

around two business lines: Local Search and Digital Marketing. With

Local Search, the Group offers digital services and solutions to clients

which enable them to enhance their visibility and develop their local

contacts. Thanks to its expertise, SoLocal Group earned the trust of

some 490,000 clients of those services and over 2.4 billions of visits

via its 4 flagship brands (PagesJaunes, Mappy, Ooreka and A Vendre A

Louer) but also through its partnerships. With Digital Marketing,

SoLocal Group creates and provides the best local and customised content

about professionals. With over 4,400 employees, including a new orders

force of 1,900 local communication advisors specialised in five

verticals (Home, Services, Retail, Health & Public, BtoB) and

Internationally (France, Spain, Austria, United Kingdom), the Group

generated in 2016 revenues of 812 millions euros, of which 80% on

Internet and ranks amongst the first European players in terms of

Internet advertising revenues. SoLocal Group is listed on Euronext Paris

(LOCAL). More information may be obtained at www.solocalgroup.com.

3 Net debt is the gross financial debt plus or minus the fair

net asset value of asset and/or liability derivative instruments used

for cash flow hedging purposes, minus cash and cash equivalents.

4

Net of bank overdrafts

IV. AppendicesConsolidated Income Statement

| In million euros | As at 30 June 2016 | As at 30 June 2017 | ||||||||||||

| Total | Recurring | Non recurring | Total | Recurring | Non recurring | Change Recurring | ||||||||

| Revenues | 405 | 405 | 386 | 386 | -5% | |||||||||

| Net external expenses | (105) | (105) | (101) | (101) | -4% | |||||||||

| Staff expenses | (188) | (188) | (193) | (193) | 3% | |||||||||

| Recurring EBITDA | 112 | 112 | 91 | 91 | -18% | |||||||||

| EBITDA | 110 | 112 | (2) | 88 | 91 | (3) | -18% | |||||||

| Depreciation and amortization | (27) | (27) | (30) | (30) | 11% | |||||||||

| Operating income | 83 | 85 | (2) | 58 | 61 | (3) | -28% | |||||||

| Net gain from debt restructuring as at 13 March 2017 | 266 | 266 | na | |||||||||||

| Other financial income | 1 | 1 | - | - | na | |||||||||

| Financial expenses | (38) | (38) | (11) | (11) | -71% | |||||||||

| Financial income | (37) | (37) | 255 | (11) | 266 | 71% | ||||||||

| Income before tax | 46 | 48 | (2) | 313 | 50 | 263 | 5% | |||||||

| Corporate income tax | (21) | (21) | 1 | (8) | (21) | 13 | -2% | |||||||

| Income for the period | 25 | 27 | (1) | 306 | 29 | 276 | 11% | |||||||

| (*) restated for the retrospective application of IAS 20 concerning the Crédit impôt recherche | ||||||||||||||

Consolidated Cash Flow Statement

| In millions of euros | H1 2016 | H1 2017 | ||

| Recurring EBITDA | 112 | 91 | ||

| Non monetary items included in EBITDA and other | 0 | (1) | ||

| Net change in working capital | (19) | (30) | ||

| Acquisition of tangible and intangible fixed assets | (36) | (26) | ||

| Cash financial income | (18) | (41) | ||

| Non recurring items | (15) | (11) | ||

| Acquisition costs of shares | - | - | ||

| Corporate income tax paid | 11 | (27) | ||

| Net cash flow | 35 | (46) | ||

| Increase (decrease) in borrowings and bank overdrafts | 15 | (270) | ||

| Capital increase | - | 273 | ||

| Other | 5 | 1 | ||

| Net cash variation | 54 | (43) | ||

| Net cash and cash equivalents at beginning of period | 53 | 91 | ||

| Net cash and cash equivalents at end of period | 108 | 48 |

Consolidated Balance Sheet

| In million of euros | ||||||

| ASSETS | 30-Jun-16 | 31-Dec-16 | 30-Jun-17 | |||

| Total non-current assets | 263 | 264 | 259 | |||

| Net goodwill | 95 | 96 | 96 | |||

| Other net intangible fixed assets | 126 | 128 | 127 | |||

| Net tangible fixed assets | 33 | 33 | 28 | |||

| Other non-current assets of which deferred tax assets | 8 | 7 | 8 | |||

| Total current assets | 489 | 506 | 402 | |||

| Net trade accounts receivable | 293 | 321 | 282 | |||

| Acquisition costs of contracts | 32 | 35 | 30 | |||

| Prepaid expenses | 12 | 6 | 9 | |||

| Cash and cash equivalents | 111 | 91 | 49 | |||

| Other current assets | 41 | 53 | 32 | |||

| TOTAL ASSETS | 752 | 769 | 660 | |||

| LIABILITIES | ||||||

| Total equity | (1,310) | (1,286) | (511) | |||

| Total non-current liabilities | 122 | 127 | 517 | |||

| Non-current financial liabilities and derivatives | 3 | 1 | 399 | |||

| Employee benefits (non-current) | 100 | 88 | 103 | |||

| Other non-current liabilities | 20 | 38 | 15 | |||

| Total current liabilities | 1,941 | 1,928 | 654 | |||

| Bank overdrafts and other short-term borrowings | 1,177 | 1,186 | 7 | |||

| Deferred income | 435 | 408 | 370 | |||

| Employee benefits (current) | 100 | 116 | 98 | |||

| Trade accounts payable | 102 | 99 | 84 | |||

| Other current liabilities | 127 | 118 | 95 | |||

| TOTAL LIABILITIES | 752 | 769 | 660 |

View source version on businesswire.com: http://www.businesswire.com/news/home/20170726006551/en/

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Solocal Group Provient regroupementmehr Nachrichten

| Keine Nachrichten verfügbar. |