|

06.12.2022 23:49:00

|

Market Forces Changing Across Ag, Machinery, and Truck Industries as Year End Approaches

LINCOLN, Neb., Dec. 6, 2022 /PRNewswire/ -- The latest market reports from Sandhills Global reveal mixed signals across Sandhills marketplaces. Used heavy-duty truck and semitrailer markets, for example, are still accruing inventory, continuing a recovery trend that began in Q2 2022 after a period of historic inventory lows. As inventory grows, used heavy-duty truck and trailer values are softening further, showing both auction and asking value decreases, although these values are still higher than they were a year ago. The used construction equipment marketplace, meanwhile, is stabilizing, with month-to-month value increases slowing down. By contrast, used agricultural equipment values are staying strong, continuing a months-long trend of M/M value increases.

The current mix of trend lines is creating a somewhat complex landscape for equipment owners as they map out year-end acquisition and disposal strategies. "We're still hearing equipment owners actively talking about market conditions and how they apply to liquidating equipment," says AuctionTime Manager Mitch Helman. "Owners are making hard decisions about whether to liquidate now or wait until next year. Many are deciding that now's the time. The way December auctions are currently shaping up, we'll exceed all previous records for end-of-year sales."

The key metric used in all of Sandhills' market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Regional EVI data is available for the United States (and key geographic regions within) and Canada, allowing Sandhills to reflect machine values by location.

TakeawaysSandhills Market Reports highlight the most significant changes in Sandhills' used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The new heavy-duty truck and semi-trailer market reports examine a regional breakdown of inventory and values, as well as auction value trends across model age years.

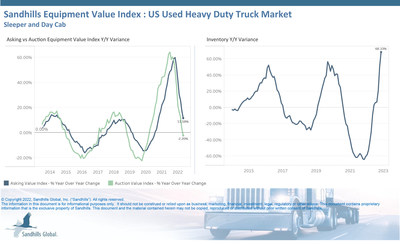

U.S. Used Heavy-Duty Trucks- The Sandhills EVI indicates that used heavy-duty truck inventory, which includes sleeper and day cab models, shot up in November, driving auction values lower. Used truck inventory levels increased 8.3% from October to November, and were up 68.3% year over year in November.

- Auction values continued a downward trend that began in April 2022, decreasing 0.8% M/M and 2.2% YOY in November. The last time YOY auction values were down for used heavy-duty trucks was in September 2020.

- Asking values decreased 0.59% M/M, continuing a trend of several months' worth of decreases. Still, asking values were up 11.58% YOY.

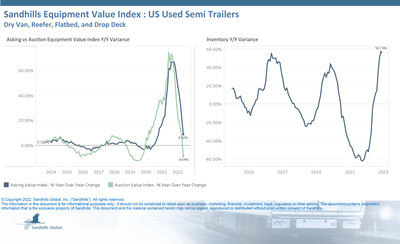

- Used semitrailer inventory levels increased considerably in November while auction and asking values continued to soften. Inventory levels were up 6.09% M/M in November and currently show an upward trend. Levels were also up over last year, posting a 56.7% YOY increase.

- Continuing months of decreases, auction values fell 6.9% M/M in November and were down 8.64% YOY.

- Asking values also continued a months-long downward trend, decreasing 0.9% M/M. However, asking values were up 8.92% YOY.

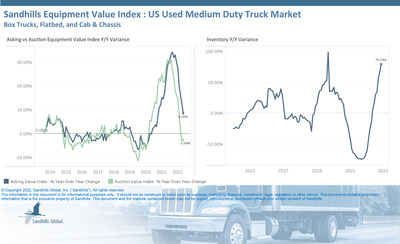

- Inventory levels in this category, which includes used box trucks, flatbed trucks, and cab and chassis trucks, were up 5.59% M/M in November and are currently tracking up. Levels increased 79.5% YOY.

- For the second month in a row, auction values for used medium-duty trucks are lower than last year's values, decreasing 2.69% YOY. Auction values increased 2.1% M/M and are currently showing a sideways trend.

- Asking values held steady M/M and were up 8.5% YOY.

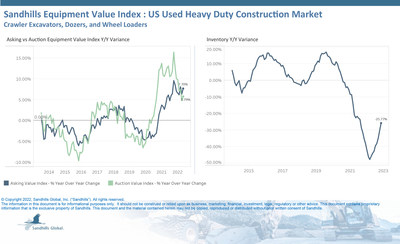

- Inventory levels for heavy-duty construction equipment, which includes excavators, dozers, and wheel loaders, have remained steady since the end of Q2 2022, showing no significant M/M change, but remain down 25.77% YOY.

- Auction values increased 1.6% M/M and are now trending sideways. Auction values increased 5.79% YOY in November.

- Asking values are showing more strength, having increased 1.39% M/M and currently trending upward. Asking values were also up YOY in November, posting a 7.7% increase.

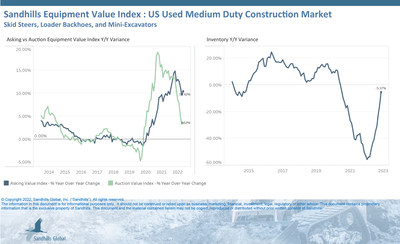

- Similar to heavy-duty construction equipment, the medium-duty category, which includes skid steers, loader backhoes, and mini excavators, has exhibited little change in inventory levels since the end of Q2 2022. Inventory levels decreased 0.8% M/M and were down 5.37% YOY in November, and are currently trending sideways.

- Within the medium-duty category, track skid steers and mini excavator inventory has been recovering the quickest in 2022.

- Auction values held steady in November and are trending downward. Auction values increased 3.52% YOY.

- Asking values also held steady in November but, unlike auction values, are trending upward. Asking values were up 10.4% YOY.

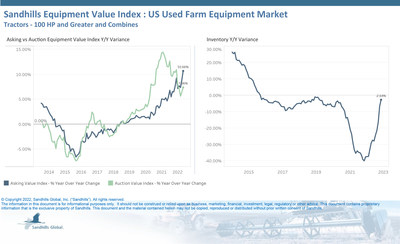

- Inventory levels of used farm equipment, which includes 100-plus-horsepower tractors and combines, are continuing to stabilize after two years of inventory declines. Inventory levels increased 4.2% M/M in November and are trending upward, but decreased 2.64% YOY.

- Auction values in this category remain elevated from a year ago, posting a 7.36% YOY increase in November. Auction values were up 2.6% M/M.

- Asking values rose 2% M/M and continue showing strength over 2021, up 10.66% YOY.

- Used high-horsepower tractors (those 300 HP and greater) are showing the largest sustained value increases this year, and as a result are bolstering overall gains in the used farm equipment category.

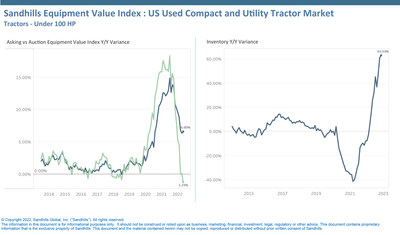

- Inventory levels in this category increased 3.29% M/M in November, continuing several consecutive months of increases, and were up 63% YOY.

- Continued inventory increases among used compact and utility tractors are taking a toll on auction values, which held steady in November but dropped 1.23% YOY. This marks the first YOY auction value decrease in this category in over two years.

- Asking values, meanwhile, increased 0.9% M/M and are trending upward. Asking values were up 6.6% YOY.

For more information, or to receive detailed analysis from Sandhills Global, contact us at marketreports@sandhills.com.

About Sandhills GlobalSandhills Global is an information processing company headquartered in Lincoln, Nebraska. Our products and services gather, process, and distribute information in the form of trade publications, websites, and online services that connect buyers and sellers across the construction, agriculture, forestry, oil and gas, heavy equipment, commercial trucking, and aviation industries. Our integrated, industry-specific approach to hosted technologies and services offers solutions that help businesses large and small operate efficiently and grow securely, cost-effectively, and successfully. Sandhills Global—we are the cloud.

About the Sandhills Equipment Value IndexThe Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills' proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.

Contact Sandhills

www.sandhills.com/contact-us

402-479-2181

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/market-forces-changing-across-ag-machinery-and-truck-industries-as-year-end-approaches-301696439.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/market-forces-changing-across-ag-machinery-and-truck-industries-as-year-end-approaches-301696439.html

SOURCE Sandhills Global

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!