|

03.08.2023 05:42:00

|

LINDIAN REPORTS MAIDEN MINERAL RESOURCE ESTIMATE OF 261 MILLION TONNES AT HIGH GRADE OF 2.19% TREO

HIGHLIGHTS

- This Mineral Resource Estimate ('MRE') places Kangankunde amongst one the world's largest rare earths deposits and positions it as a globally strategic resource for secure, long-term supply

- 5.7 million tonnes contained rare earths

- Includes 1.2 million tonnes of contained rare earths critical metal elements neodymium-praseodymium (NdPr)

- NdPr ratio averages 20.2% of TREO

- Non-radioactive mineralisation

- MRE includes multiple higher-grade subsets

- 23MT @ 3.23% TREO and the focus for the initial Stage 1 mine development

- 60MT at 2.4% TREO

- 46MT at 2.34% TREO

- Mineralisation remains open at depth and beyond some areas of the current mineral resource envelope

- With the MRE now published, Lindian is well-placed to advance offtake discussions with multiple parties that have expressed interest

- Multiple near-term value catalysts pending

Lindian's Executive Chairman, Asimwe Kabunga commented: "Our maiden Mineral Resource Estimate marks a key milestone for Lindian and positions us as a major player in the global rare earths sector. We can confidently claim Kangankunde is one of the world's largest rare earths projects superior in terms of tonnage matched with excellent grade and contaning a high percentage of critical metal elements neodymium-praseodymium (NdPr), and uniquely, material that is non-radioactive. This makes the project highly attractive to parties seeking secure, long term supply, many of which have expressed an interest in Kangankunde's material. Our focus now turns to locking in these offtake agreements and advancing contruction of our stage 1 plant to deliver first product in 2024."

Chief Executive Officer, Alistair Stephens added: "In a little over 10 months, and based on just 14,000 metres of drilling, Lindian has established a vastly superior rare earths resource that positions us in the top echelons of critical minerals companies globally. It is worth noting that the resource remains open. It is an outstanding outcome and I would like to acknowledge the hard work of our technical team in Malawi, and notably, the support of the Malawi Government and the local community. This MRE underpins the next phase of value catalysts for Lindian including mine and processing development activities and offtake agreements. We have a number of meaningful announcements pending that will deliver further value."

SYDNEY, Aug. 2, 2023 /PRNewswire/ -- Lindian Resources Limited (ASX:LIN) ("Lindian" or "the Company") is pleased to announce the maiden Mineral Resource Estimate (MRE) for the Kangankunde Rare Earths Project in Malawi of 261 million tonnes averaging 2.19% TREO above a 0.5% TREO cutoff grade. The resource is entirely Inferred status, has been estimated in accordance with JORC 2012 guidelines and is summarised in Table 1.

Table 1: Kangankunde Rare Earths Project Mineral Resource Above 0.5% TREO Cut-off Grade

Resource Classification | Tonnes (millions) | TREO (%) | NdPr% of TREO** (%) | Tonnes Contained NdPr* (millions) |

Inferred Resource | 261 | 2.19 | 20.2 | 1.2 |

Rounding has been applied to 1.0Mt for tonnes and 0.1% NdPr% of TREO which may influence total calculation.

* NdPr = Nd2O3 + Pr6O11, ** NdPr% / TREO% x 100

This MRE places Kangankunde amongst the world's largest rare-earth deposits and as such is a globally strategic resource for long-term security of rare earth supply.

Table 2 Kangankunde Rare Earths Mineral Resource by Estimation Domain (at 0.5% TREO cut-off)

Inferred Classification by Domain | Tonnes (millions) | TREO (%) | NdPr% of TREO (%) | Tonnes Contained NdPr* (000's) |

Domain 1 | 58 | 1.76 | 22.0 | 225 |

Domain 2 | 72 | 1.91 | 20.7 | 285 |

Domain 3 | 23 | 3.23 | 18.5 | 137 |

Domain 4 | 60 | 2.40 | 19.5 | 281 |

Domain 5 | 46 | 2.34 | 20.4 | 220 |

* NdPr = Nd2O3 + Pr6O11. Rounding has been applied to 1.0Mt for tonnes and 0.1% NdPr% of TREO which may influence total calculation.

Resource estimation utilised multi-element relationships from rock chemistry and rare earth mineralisation to define five domains within the overall carbonatite. These domains were assessed against geological understanding and field observations from surface mapping and drill core and were considered appropriate representations of the mineralisation distribution. The resource estimation by domains is summarised in Table 2

Domain 3 is a high-grade domain that will be the focus for initial development planning.

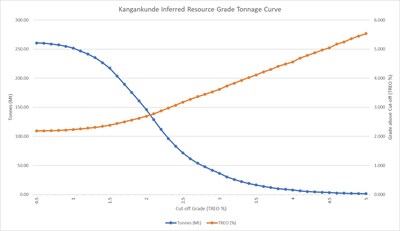

Grade tonnage curve analysis of the resource shows the robustness of grade continuity in the resource with a reduction in tonnes and increase in grade with increasing cut-off.

Tables 4 to 6 list the resources in detail by rare earth element and in commonly reported accumulations.

SUMMARY OF MATERIAL INFORMATION USED TO ESTIMATE THE MINERAL RESOURCE

The following is a summary of material information used to estimate the Mineral Resource, as required by Listing Rule 5.8.1 and JORC 2012 Reporting Guidelines.

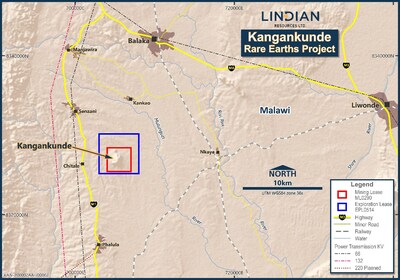

Mineral Tenement and Land Tenure Status

The Kangankunde Rare Earths Project is located in the south of Malawi, 90 km north of the city of Blantyre. The mineral tenements include a Medium Scale Mining Licence (MML0290/22) which is surrounded by Exploration Licence EPL0514/18R (Figure 2). The Exploration and Mining Licences have an Environmental and Social Impact Assessment Licence No.2:10:16 issued under the Malawi Environmental Management Act No. 19 of 2017.Both licences are in good standing with no known impediments.

Table 3: Kangankunde Rare Earths Project Tenement Details.

Licence ID | Licence Type | Granted Date | Expiry / Renewal Date | Area (km2) |

MML0290/22 | Medium Scale Mining | 22 April 2022 | 22 April 2032 | 9.0 |

EPL0514/18R | Exploration | 16 October 2021 | 16 October 2023 | 16.0 |

On 1 August 2022 Lindian announced the acquisition of 100% of Malawian registered Rift Valley Resource Developments Limited (Rift Valley) and its 100% owned title to Exploration Licence EPL0514/18R and Mining Licence MML0290/22.

Under the terms of the Transaction, Lindian has an agreement to acquire all the shares in Rift Valley from its existing shareholders for US$30 million, payable in tranches. To date, Lindian has paid US$20.0 million in cash and is the registered owner of 67% of the shares in Rift Valley. The remaining amount of US$10.0 million is due 48 months from the signature date of the Share Purchase Agreement, or on the commencement of production (refer ASX release 1 August 2022) at which time the remaining 33% of the shares in Rift Valley will be transferred to Lindian.

Geology

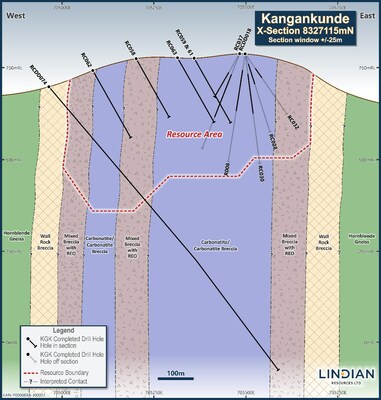

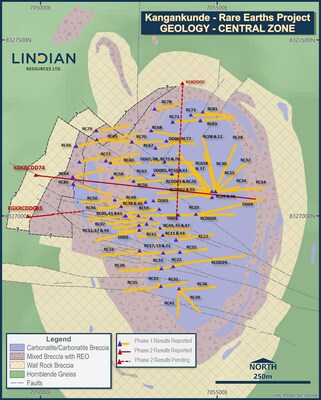

The Kangankunde Hill rises to a height of up to 200 m above the surrounding plain. The deposit contains a central zone of carbonatite rocks passing outwards to a series of zones of altered breccias of varying composition of carbonatite and wall rock clasts in a carbonatite matrix, and ultimately into unaltered gneiss host rock (Figure 3). Similar to many rare earth deposits, the main rare earth containing mineral in the deposit is monazite.

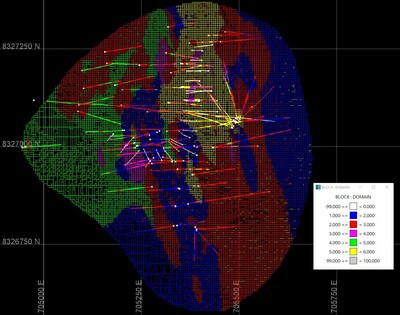

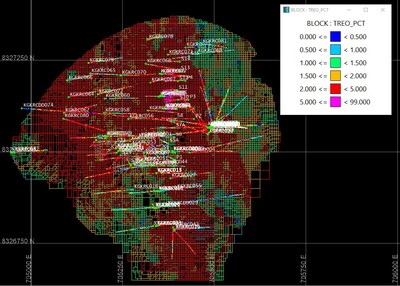

Estimation domaining utilised multi-element relationships from minor rock chemistry and rare earth mineralisation to define five domains within the overall carbonatite limits. These domains were assessed against geological understanding and field observations from surface mapping and drill core and were considered appropriate representations of the mineralisation distribution. Leapfrog was utilised to build mineralisation domain wireframes and to code sample intervals with the applicable domain. A plan representation of the defined domains is presented in Figure 4.

Drilling Techniques and Hole Spacing

Drilling completed at the Kangankunde Rare Earths Project and used to support the MRE includes eight diamond core (DD) holes, 76 reverse circulation (RC) holes, and 7 RC holes with diamond core tails (RCD) for a total of 15,831 m (Figure 5).

All holes are drilled from surface with various orientations depending on terrain constraints. RC drilling utilised a 5.25" (134 mm) face sampling hammer to generate one-metre samples, which are placed into large plastic bags marked with the hole ID and sample interval. Sample weights are recorded for each sample, with recovery maximised via use of PVC collars in upper portions of the collar.

Diamond drilling used a HQ triple tube size (~61.1 mm diameter) with the triple tube techniques used to maximise core recovery. NQ core was used for deeper drill holes. Drill core was collected from a core barrel and placed in appropriately marked core trays. Down hole core run depths were measured and marked with core blocks. Core was measured for core loss and core photography and geological logging completed.

Sampling

Samples from the RC drilling are collected on one-metre intervals from the rig mounted cyclone and placed into large plastic bags. These are subsequently split using a two-tier riffle splitter to obtain a ¼ sub-sample. This is subsequently reduced in a single-tier riffle splitter to generate an A and B sample reduced to a nominal 1.5 kg. Sample lengths for diamond drilling were determined by geological boundaries with a maximum sample length of 2 metres applied. The core was cut using an electric core saw. Quarter core was submitted to ALS for chemical analysis using industry standard sample preparation and analytical techniques.

Certified reference materials (CRM), analytical blanks, and field duplicates were used as part of the QAQC procedures and were each inserted at a rate of 1:20 samples.

Sample Analysis

All samples were dispatched by air freight direct to ALS laboratory in Johannesburg for sample preparation. Following sample preparation, a 30-gram pulverised sub-sample is shipped to ALS Perth Australia for analysis. Sample preparation included whole sample crushing to 70% less than 2mm, Boyd rotary slitting to generate a 750g sub-sample, and pulverising to achieve better than 85% passing 75 microns. Analysis for REE suite was via Lithium Borate Fusion ICP-MS (ALS code ME-MS81h), with elements analysed at ppm levels. This method is considered a total analysis.

Bulk Density

Insitu dry bulk density was determined using the Archimedes method on a 20 metre downhole interval from available core drilling. A total of 96 samples were tested with dry bulk density ranging from 2.08 g/cm3 to 3.45 g/cm3 with the average of 2.95 g/cm3 used in resource estimation. Future work should include more testing and establishment of a grade density relationship if possible.

Estimation Methodology

Drill hole sample data was composited to one-metre downhole lengths using a best fit-method. No residuals were generated.

A total of 15 REE grade attributes (Y, La, Ce, Pr, Nd, Sm, Eu, Gd, Tb, Dy, Ho, Er, Tm, Yb, and Lu), and two deleterious elements (U, and Th) were estimated. Final estimated values are converted to stoichiometric oxide values by calculation using published ratios to support reporting of rare earth oxides (REO). The grade estimation process was completed using Maptek Vulcan software using Ordinary Kriging (OK). The variogram for La was applied to the other light rare earth elements, while the Dy variogram was applied for the heavy rare earths. Other variables were directly modelled.

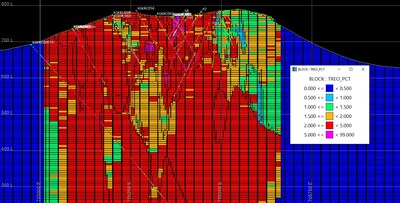

Interpolation parameters were derived using standard exploratory data analysis techniques of statistical and continuity analysis. Appropriate interpolation strategies were developed using kriging neighbourhood analysis (KNA) with a minimum number of 6 composites and a maximum number of 16 composites, with an octant search applied with a restriction on the number of composites per octant set to four. Blocks were estimated in a two-pass strategy with first pass maximum search distances between 190 and 375 metres depending on estimation variable. The second pass doubled the first pass search distance and removed the octant restriction. Blocks not estimated after the second pass were assigned a background waste grade. A cross section looking north with estimated TREO block grades is presented in Figure 6.

The model has a block size of 25 m (X) by 25 m (Y) by 5 m (Z) with sub-celling of 5 m (X) by 5 m (Y) by 2.5m (Z). Grades were estimated into the parent cells.

The block model was validated using a combination of visual and statistical techniques including global statistics comparisons, correlation coefficients comparisons, and trend plots.

Resource Classification

A range of criteria was considered by Cube when addressing the suitability of the classification boundaries. These criteria include:

- Geological continuity and volume;

- Drill spacing and drill data quality;

- Modelling technique; and

- Estimation properties, including search strategy, number of informing composites, average distance of composites from blocks and kriging quality parameters.

Blocks have been classified exclusively in the Inferred category and constrained inside a drilling footprint, with maximum extrapolation of ~100 m from drill holes (Figure 7).

Cut-off Grade

The Mineral Resource has been reported above a 0.5% total rare earth oxide (TREO) cut-off. Determination of an appropriate cut-off grade has considered recent metallurgical test work rare earth recoveries and concentrate parameters (ASX release 11 April 2023). Based on these results a price for the predicted contained REO product has been derived from 3rd party pricing forecasts and NSR calculation.

These assumptions, together with other cost inputs, were utilised in definition of an optimisation shell to assess the impact of assumed geotechnical constraints and associated strip ratio on the portions of the Mineral Resource which may not be economically recovered. In the opinion of the Competent Person, the results of the optimisation demonstrate that the project has met the conditions for reporting of a Mineral Resource with reasonable prospects of economic extraction.

Mining and Metallurgy

Development of this Mineral Resource assumes mining using standard equipment and methods. The assumed mining method is open pit mining at an appropriate bench height with conventional drill and blast with excavator and truck configuration for load and haul. Lindian Resources Ltd have completed initial metallurgy test work that resulted in the qualification of a water-based gravity separation process and resulted in a recovery of 70% at a concentrate grade of 60% TREO (refer ASX release dated 11th April 2023). These results together with indicative mining and processing costs and other cost inputs are considered adequate to achieve reasonable expectations of economic metallurgical processing of the project mineralisation.

Table 4: Kangankunde Rare Earths Mineral Resource (at 0.5% TREO cut-off)

Class | Tonnes (Mt) | La2O3 (ppm) | CeO2 (ppm) | Pr6O11 (ppm) | Nd2O3 (ppm) | Sm2O3 (ppm) | Eu2O3 (ppm) | Gd2O3 (ppm) | Tb4O7 (ppm) | Dy2O3 (ppm) | Ho2O3 (ppm) | Er2O3 (ppm) | Tm2O3 (ppm) | Yb2O3 (ppm) | Lu2O3 (ppm) | Y2O3 (ppm) |

Inferred | 261 | 5,970 | 11,040 | 1,100 | 3,330 | 240 | 40 | 70 | 5 | 15 | 2 | 3 | 0.3 | 2 | 0.3 | 45 |

Table 5: Kangankunde Rare Earths Mineral Resource (at 0.5% TREO cut-off)

Classification | Tonnes (Mt) | TREO (%) | HREO (%) | LREO (%) | NdPr (ppm) | NdPr % of TREO (%) | SEG (ppm) | TbDy (ppm) | U3O8 (ppm) | ThO2 (ppm) |

Inferred | 261 | 2.19 | 0.02 | 2.17 | 4,430 | 20.2 | 350 | 20 | 6 | 50 |

Table 6: Kangankunde Rare Earths Mineral Resource by Estimation Domain (at 0.5% TREO cut-off)

Classification | Estimation Domain | Tonnes (Mt) | TREO (%) | HREO (%) | LREO (%) | NdPr (ppm) | NdPr % of TREO (%) | SEG (ppm) | TbDy (ppm) | U3O8 (ppm) | ThO2 (ppm) |

Inferred | 1 | 58 | 1.76 | 0.02 | 1.74 | 3,880 | 22.0 | 340 | 20 | 8 | 50 |

2 | 72 | 1.91 | 0.02 | 1.89 | 3,950 | 20.7 | 340 | 25 | 8 | 50 | |

3 | 23 | 3.23 | 0.02 | 3.21 | 5,980 | 18.5 | 415 | 20 | 3 | 65 | |

4 | 60 | 2.40 | 0.01 | 2.39 | 4,690 | 19.5 | 335 | 15 | 1 | 35 | |

5 | 46 | 2.34 | 0.02 | 2.33 | 4,770 | 20.4 | 340 | 20 | 10 | 50 |

Notes: All ppm rounded from original estimate to the nearest 10 ppm. Minor variables rounded to nearest 1 ppm however these are immaterial overall. Percentages rounded to nearest 0.01% which may lead to differences in averages from Table 4.

Y2O3 is included in the TREO and HREO calculation.

TREO (Total Rare Earth Oxide) = La2O3 + CeO2 + Pr6O11 + Nd2O3 + Sm2O3 + Eu2O3 + Gd2O3 + Tb4O7 + Dy2O3 + Ho2O3 + Er2O3 + Tm2O3 + Yb2O3 + Y2O3 + Lu2O3.

HREO (Heavy Rare Earth Oxide) = Sm2O3 + Eu2O3 + Gd2O3 + Tb4O7 + Dy2O3 + Ho2O3 + Er2O3 + Tm2O3 + Yb2O3 + Y2O3 + Lu2O3

LREO (Light Rare Earth Oxide) = La2O3 + CeO2 + Pr6O11 + Nd2O3

SEG = Sm2O3 + Eu2O3 + Gd2O3

TbDy = Tb4O7 + Dy2O3

NdPr = Pr6O11 + Nd2O3

U and Th are deleterious elements being reported in accordance with JORC (2012) Guidelines.

This ASX announcement was authorised for release by the Lindian Board.

About Lindian

RARE EARTHS

Lindian Resources Limited is the holder of Malawian registered Rift Valley Resource Developments Limited and its 100% owned title to Exploration Licence EPL0514/18R and Mining Licence MML0290/22 issued under the Malawi Mines and Minerals Act 2018. The Exploration and Mining Licences have an Environmental and Social Impact Assessment Licence No.2:10:16 issued under the Malawi Environmental Management Act No. 19 of 2017.

BAUXITE

Lindian Resources Limited has over 1 billion tonnes of Bauxite resources (refer company website for access to resources statements and competent persons statements) in Guinea with the Gaoual, Lelouma and Woula projects. Guinean bauxite is known as the premier bauxite location in the world, having high grade and low impurities premium quality bauxite.

Forward Looking Statements

This announcement may include forward-looking statements, based on Lindian's expectations and beliefs concerning future events. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of Lindian, which could cause actual results to differ materially from such statements. Lindian makes no undertaking to subsequently update or revise the forward-looking statements made in this announcement, to reflect the circumstances or events after the date of the announcement.

Competent Persons Statements

The information in this Report that relates to exploration results including drilling, sampling, assay and bulk density data applied to the mineral resource estimate for the Kangankunde Project is based on information compiled by Mr. Geoff Chapman, who is a Fellow of the Australian Institute of Mining and Metallurgy (AusIMM). Mr. Chapman is the principal of geological consultancy GJ Exploration Pty Ltd that is engaged by to Lindian Resources Limited. Mr. Chapman has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' (JORC Code).

Mr. Chapman consents to the inclusion in this report of the matters based on the information in the form and context in which it appears.

The information in this report that relates to Mineral Resources is based on information compiled by Mr Daniel Saunders, a Competent Person who is a Fellow of The Australasian Institute of Mining and Metallurgy. Mr Saunders is a full-time employee of Cube Consulting Pty Ltd, acting as independent consultants to Ionic Rare Earths Limited. Mr Saunders has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration, and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' (JORC Code).

Mr Saunders consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lindian-reports-maiden-mineral-resource-estimate-of-261-million-tonnes-at-high-grade-of-2-19-treo-301892330.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lindian-reports-maiden-mineral-resource-estimate-of-261-million-tonnes-at-high-grade-of-2-19-treo-301892330.html

SOURCE Lindian Resources

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Linde plcmehr Nachrichten

| Keine Nachrichten verfügbar. |

Analysen zu Linde plcmehr Analysen

| 27.11.23 | Linde Buy | UBS AG | |

| 20.11.23 | Linde Buy | UBS AG | |

| 30.10.23 | Linde Kaufen | DZ BANK | |

| 30.10.23 | Linde Buy | UBS AG | |

| 24.10.23 | Linde Buy | UBS AG |