|

18.10.2018 14:05:00

|

E*TRADE Study Reveals Positive Investor Sentiment Entering Midterm Elections

E*TRADE FINANCIAL Corporation (NASDAQ:ETFC) today announced results from the most recent wave of StreetWise, the E*TRADE quarterly tracking study of experienced investors. Amid increasing trade barbs, geopolitical unrest, and a late-stage economy, results show investors are hopeful that the midterm elections will have a positive impact on their investments:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181018005441/en/

Young investors are most likely to believe the midterm elections will positively affect their portfolios (Graphic: Business Wire)

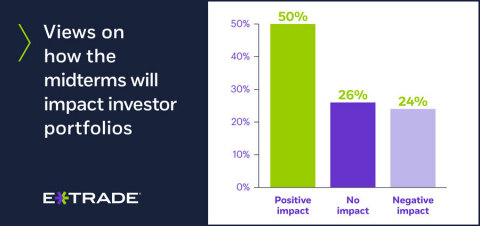

- Half of all investors (50%) think the results of the midterm election will have a positive effect on their investment portfolios, versus only a quarter (24%) who believe it will negatively affect their portfolio.

- Young investors have an even rosier outlook: Seven out of 10 (70%) have a positive outlook on the effect of the midterm elections compared to just one-third (34%) of Baby Boomers.

- Parties are split: When asked which party will be more beneficial to their portfolios, investors were divided, with 51% favoring the Republican party and 49% favoring the Democratic party.

- Almost two-thirds (64%) of surveyed investors believe the market will rise this quarter, up 12 percentage points from Q3’18.

- More than 60 percent (63%) of investors believe the US economy is healthy enough for one more rate hike in the fourth quarter, up 6 percentage points from Q3’18 and 4 percentage points from Q4’17.

"The midterm elections bring a lot of question marks to the table, but we’re seeing relatively positive and hopeful sentiment, particularly among young investors,” commented Mike Loewengart, VP of Investment Strategy at E*TRADE Financial. "The results of the election could have a ripple effect on the economy, with trade, tax reform, and government debt all subject to change. While we’re on strong economic footing, we’re starting to see increased volatility, and there are some headwinds investors should be aware of, such as trade, inflation, housing weakness, and ballooning government debt.”

The survey also explored retail investors’ thoughts on sector opportunities for the fourth quarter of 2018, and the results indicate this population may be taking a diversified approach ahead of the unknown, choosing the following sectors:

- IT. Surveyed investors exhibit a growth mindset, homing in on the strong performance of the tech sector, despite the relatively high valuations. In fact, almost half (48%) of investors say technology stocks offer the most potential this quarter.

- Health care. On the other hand, investors also show interest in this more defensive sector, as the midterm election and its uncertain outcome approaches. This quarter, 44% of investors were drawn to health care investments.

- Energy. Lastly, investors may also see opportunity in the demand for oil, strong global growth, and supply constraints that are expected to keep the price of natural gas and crude oil high. About two out of five investors (42%) would choose energy in their portfolio, keeping it among the top three preferred sectors this quarter.

E*TRADE aims to enhance the financial independence of traders and investors through a powerful digital offering and professional guidance. To learn more about E*TRADE’s trading and investing platforms and tools, visit etrade.com.

For useful trading and investing insights from E*TRADE, follow the company on Twitter, @ETRADE.

About the Survey

This wave of the survey was conducted from

October 1 to October 9 of 2018 among an online US sample of 956

self-directed active investors who manage at least $10,000 in an online

brokerage account. The survey has a margin of error of ±3.20 percent at

the 95 percent confidence level. It was fielded and administered by

Research Now. The panel is broken into thirds of active (trade more than

once a week), swing (trade less than once a week but more than once a

month), and passive (trade less than once a month). The panel is 60%

male and 40% female, with an even distribution across online brokerages,

geographic regions, and age bands.

|

Referenced Data |

||||||||||

| What impact do you think the results of the midterm election will have on your investment portfolios? | ||||||||||

| Total | Age | |||||||||

| Q4’18 | <34 | 55+ | ||||||||

| Positive (Top 3 Box) | 50% | 70% | 34% | |||||||

| Very Positive Impact | 8% | 16% | 2% | |||||||

| Positive Impact | 18% | 27% | 11% | |||||||

| Somewhat positive impact | 24% | 27% | 21% | |||||||

| No impact | 26% | 18% | 31% | |||||||

| Somewhat negative impact | 21% | 11% | 29% | |||||||

| Negative impact | 3% | 1% | 5% | |||||||

| Very Negative Impact | 0% | 0% | 1% | |||||||

| Negative Impact (Bottom 3) | 24% | 12% | 35% | |||||||

|

If you had to choose, in general, which party do you think will

be the most beneficial to |

||||

| Total | ||||

| Q4’18 | ||||

| Democratic Party | 49% | |||

| Republican Party | 51% | |||

| How do you predict the market will end this quarter? | ||||||||||||||||

| Q4’18 | Q3’18 | Q2’18 | Q1’18 | Q4’17 | ||||||||||||

| Rise | 64% | 52% | 46% | 77% | 66% | |||||||||||

| Rise 20% | 1% | 2% | 2% | 2% | 2% | |||||||||||

| Rise 15% | 5% | 5% | 3% | 7% | 6% | |||||||||||

| Rise 10% | 17% | 13% | 11% | 18% | 16% | |||||||||||

| Rise 5% | 41% | 32% | 30% | 50% | 42% | |||||||||||

| Stay basically where it is | 19% | 23% | 17% | 14% | 17% | |||||||||||

| Drop 5% | 12% | 17% | 21% | 7% | 11% | |||||||||||

| Drop 10% | 4% | 6% | 12% | 2% | 4% | |||||||||||

| Drop 15% | 1% | 1% | 3% | 0% | 2% | |||||||||||

| Drop 20% | 0% | 1% | 1% | 0% | 0% | |||||||||||

| Drop | 17% | 25% | 37% | 9% | 17% | |||||||||||

| Is the US economy healthy enough for the Fed to enact additional rate hikes this quarter? | ||||||||||||||||

| Q4’18 | Q3’18 | Q2’18 | Q1’18 | Q4’17 | ||||||||||||

| Agree (Top 2 Box) | 63% | 57% | 58% | 66% | 59% | |||||||||||

| Strongly agree | 18% | 16% | 17% | 20% | 17% | |||||||||||

| Somewhat agree | 45% | 41% | 41% | 46% | 42% | |||||||||||

| Neither agree nor disagree | 25% | 27% | 25% | 25% | 27% | |||||||||||

| Somewhat disagree | 10% | 13% | 13% | 7% | 12% | |||||||||||

| Strongly disagree | 2% | 3% | 4% | 2% | 2% | |||||||||||

| Disagree (Bottom 2 Box) | 12% | 16% | 17% | 9% | 14% | |||||||||||

| What industries do you think offer the most potential this quarter? (Top three) | ||||||||||||||||

| Q4’18 | Q3’18 | Q2’18 | Q1’18 | Q4’17 | ||||||||||||

| Information technology | 49% | 45% | 44% | 45% | 46% | |||||||||||

| Health care | 44% | 41% | 46% | 41% | 43% | |||||||||||

| Financials | 40% | 41% | 40% | 43% | 39% | |||||||||||

| Energy | 42% | 43% | 41% | 47% | 44% | |||||||||||

| Industrials | 21% | 22% | 22% | 29% | 22% | |||||||||||

| Utilities | 23% | 24% | 22% | 19% | 22% | |||||||||||

| Communications services | 21% | 27% | 24% | 23% | 27% | |||||||||||

| Consumer discretionary | 22% | 19% | 18% | 15% | 16% | |||||||||||

| Consumer staples | 21% | 19% | 24% | 17% | 20% | |||||||||||

| Materials | 17% | 20% | 20% | 21% | 20% | |||||||||||

"Young Investor” defined as age 18–34 // "Baby Boomer” defined as age 55+

About E*TRADE Financial and Important Notices

E*TRADE

Financial and its subsidiaries provide financial services including

brokerage and banking products and services to retail customers.

Securities products and services are offered by E*TRADE Securities LLC

(Member FINRA/SIPC). Commodity futures and options on futures products

and services are offered by E*TRADE Futures LLC (Member NFA). Managed

Account Solutions are offered through E*TRADE Capital Management, LLC, a

Registered Investment Adviser. Bank products and services are offered

by E*TRADE Bank, and RIA custody solutions are offered by E*TRADE

Savings Bank, both of which are national federal savings banks (Members

FDIC). More information is available at www.etrade.com.

The information provided herein is for general informational purposes only and should not be considered investment advice. Past performance does not guarantee future results.

E*TRADE Financial, E*TRADE, and the E*TRADE logo are trademarks or registered trademarks of E*TRADE Financial Corporation. ETFC-G

© 2018 E*TRADE Financial Corporation. All rights reserved.

E*TRADE Financial Corporation and Research Now are separate companies that are not affiliated. E*TRADE Financial Corporation engages Research Now to program, field, and tabulate the study. Research Now Group, Inc. provides digital research data and has locations in the Americas, Europe, the Middle East and Asia-Pacific. For more information, please go to www.researchnow.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20181018005441/en/

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu E*TRADE FINANCIAL Corp.mehr Nachrichten

| Keine Nachrichten verfügbar. |